Financial Resources & News

New Year. New Promotions.

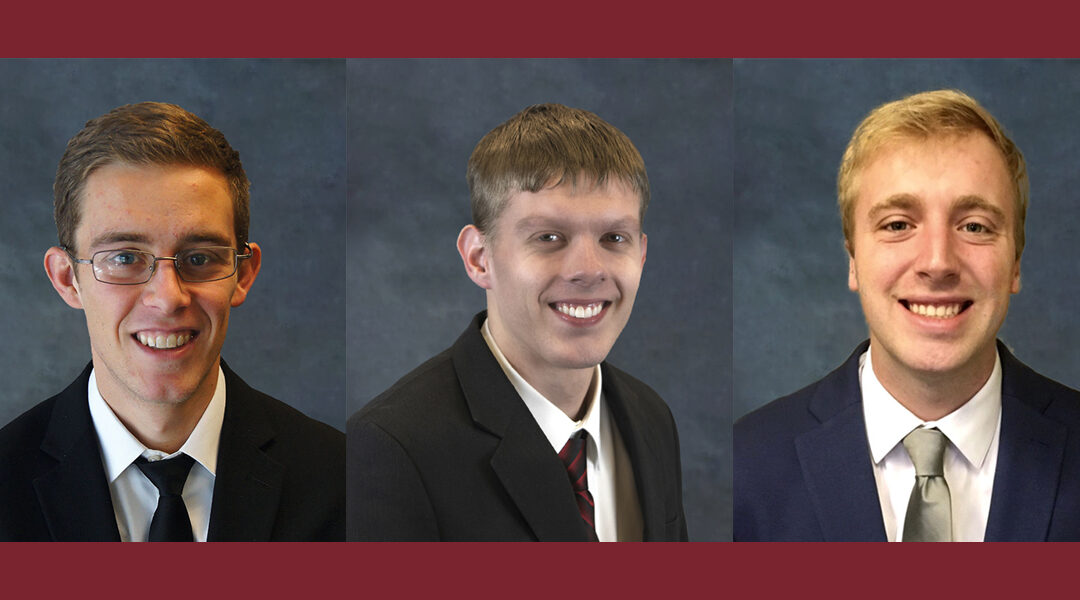

Chicago, IL, January 19, 2021 Bronswick Benjamin is pleased to announce three promotions of our professionals. Dylan Creger will be promoted from Senior Accountant to Supervisor. Daniel Fredrickson and David Thompson will transition from their current roles as...

PPP Application Dates Announced

PPP Application Dates Announced The application window for Paycheck Protection Program (PPP) forgivable loans will open Friday for lenders with $1 billion or less in assets, the US Small Business Administration and Treasury announced. The opening, which will take...

New COVID-19 Relief Bill

[vc_row][vc_column][vc_column_text] New COVID-19 Relief Bill Last night, the U.S. Senate and House of Representatives overwhelmingly passed a $900 billion COVID-19 relief bill that provides more than $300 billion in aid for small businesses, $600 stimulus payments to...

Critical Tax Points – Part 2

[vc_row][vc_column][vc_column_text] Tax Relief Strategies: Uncover Tax Relief Opportunities These additional tax strategies extend beyond the typical income tax planning steps: Uncovering missed opportunities for savings: Look for items that have the potential to...

Trust, But Verify

Trust, But Verify There is significant debate over whether there is validity to a management style of “trust, but verify”. There is no debating, however, that the old Russian proverb makes sense in considering an entity’s operations. As much as a business owner can,...

The Strategy to Use for Your PPP Loan Forgiveness Process

Do not rush the process but be prepared for the forgiveness and the tax liability that may exist.

Session Overview. Identify the vital elements needed to maximize your loan forgiveness and understand what liability may exist with your PPP loan. We will walk through practical hands on examples of what you will need to do to guide compliance for pursuing forgiveness.

There is an income tax with your PPP loan

There is an income tax with your PPP loan. As of today, any expenditures made with PPP funding is not tax deductible. To give you a quick example of the potential impact let us examine a $250,000 PPP loan. Assuming you followed the rules and properly documented your...

Employee Payroll Tax Deferral Update

Employee Payroll Tax Deferral Update On August 28, 2020, the IRS issued Notice 2020-65 that provides some needed guidance for employers in regards to the employee payroll tax deferral described in the August 8, 2020 Presidential memorandum (often referred to as an...

Do Not Rush Your PPP Loan Forgiveness Application

Do Not Rush Your PPP Loan Forgiveness Application Most lending institutions are not processing loan forgiveness applications and when they are ready there is no reason you need to be first in line. Take your time. Let others iron out the process first. Some key...