Financial Resources & News

Unemployment Fraud Continues to Thrive

Unemployment Fraud Continues to Thrive The Illinois Department of Employment Security (IDES) has reportedly stopped around 1,000,000 fraudulent unemployment claims since March of 2020. That number continues to grow at an alarming pace. There are many consequences when...

Employee Retention Credits (ERC)

Employee Retention Credits (ERC) Implemented as a refundable credit under the CARES Act, the employee retention credit is extended through June 30, 2021. The following also applies for calendar quarters beginning after December 31, 2020: The credit rate is increased...

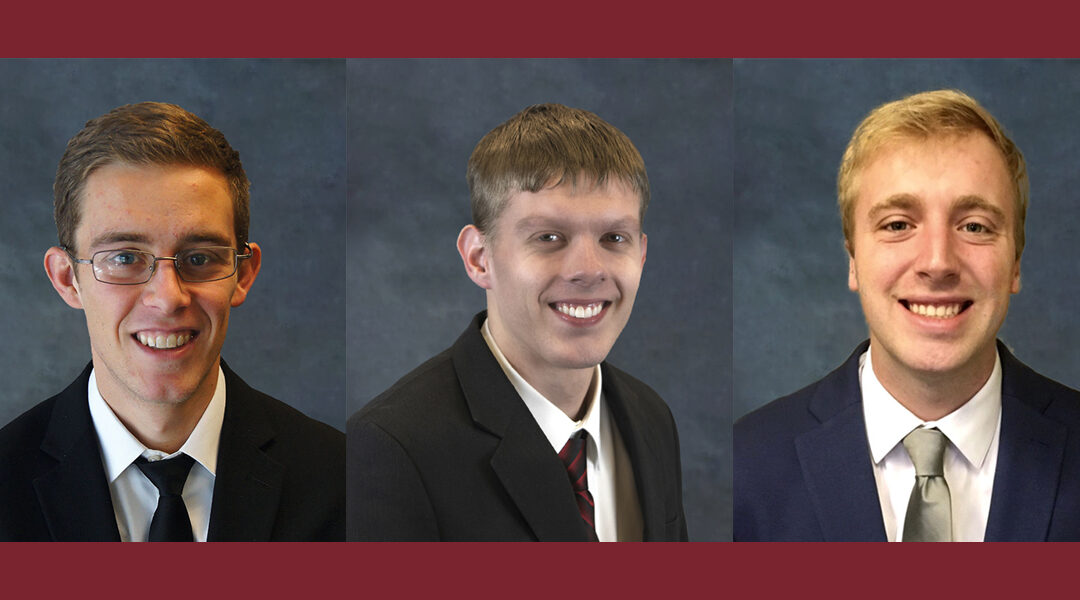

New Year. New Promotions.

Chicago, IL, January 19, 2021 Bronswick Benjamin is pleased to announce three promotions of our professionals. Dylan Creger will be promoted from Senior Accountant to Supervisor. Daniel Fredrickson and David Thompson will transition from their current roles as...

PPP Application Dates Announced

PPP Application Dates Announced The application window for Paycheck Protection Program (PPP) forgivable loans will open Friday for lenders with $1 billion or less in assets, the US Small Business Administration and Treasury announced. The opening, which will take...

KPIs and Why Do They Matter

KPIs and Why Do They Matter Key Performance Indicators (KPIs) are critical to monitor your progress. Typically, these are simple to set up to monitor. If they are not easy to set-up that is a sign your accounting software may need to be updated or more likely that you...

Setting Stretch Goals

Setting Stretch Goals Goal setting should be more of an exercise than it is. How did you set your goals? Did you pick a number and then do the math needed to get there? You need to set a numerical target, but goal setting should be a session that makes you think. It...

Building Value

Building Value Businesses exist to enable your family to live, but it is more than just money. They are a source of personal interest and financial stability for employees. The business provides needed services or products of value for your customers. Along the way,...

The Impact of Sales Acceptance Policies

The Impact of Sales Acceptance Policies Every dollar seems incredibly valuable to every business, but not every dollar has equal value. The easiest sale to make is one that typically fits into one of these three situations: This could be intentional by applying a...

Increasing Cash Flow

Increasing Cash Flow Cash flow is vital to any business. The primary reason any company has a loan or a line of credit is because they did not have the cash. Some capital to buy large equipment, a facility, etc. is needed rather than tying up working capital. The...