Financial Resources & News

2023 Year-End Guide – Partnerships

The IRS in the past year has been actively challenging partnerships’ tax positions in court – from the valuation of granted profits interests to limited partner self-employment exemption claims and the structuring of leveraged partnership transactions. At the same time, the agency is dedicating to new funding and resources to examining partnerships.

2023 Year-End Guide – International Tax

2023 has seen important activity with regulation of international tax. Following is a list of items to consider and be aware of for 2023 year-end planning and beyond.

2023 Year-End Guide – State and Local Tax

With thousands of taxing jurisdictions, from school boards to counties and states, and many different types of taxes, state and local taxation is complex. Each tax type comes with its own set of rules — by jurisdiction — all of which require a different level of attention.

2023 Year-End Guide – Tax Accounting Methods

A taxpayer’s tax accounting methods determine when income is recognized and costs are deducted for income tax purposes. Strategically adopting or changing tax accounting methods can provide opportunities to drive tax savings and increase cash flow.

American Rescue Plan Act of 2021

American Rescue Plan Act of 2021 President Biden signed the American Rescue Plan Act of 2021 (ARPA) into law on Thursday afternoon. This $1.9 trillion stimulus package contains additional funding and expansion of tax credits to qualifying small businesses, assistance...

Unemployment Fraud Continues to Thrive

Unemployment Fraud Continues to Thrive The Illinois Department of Employment Security (IDES) has reportedly stopped around 1,000,000 fraudulent unemployment claims since March of 2020. That number continues to grow at an alarming pace. There are many consequences when...

Employee Retention Credits (ERC)

Employee Retention Credits (ERC) Implemented as a refundable credit under the CARES Act, the employee retention credit is extended through June 30, 2021. The following also applies for calendar quarters beginning after December 31, 2020: The credit rate is increased...

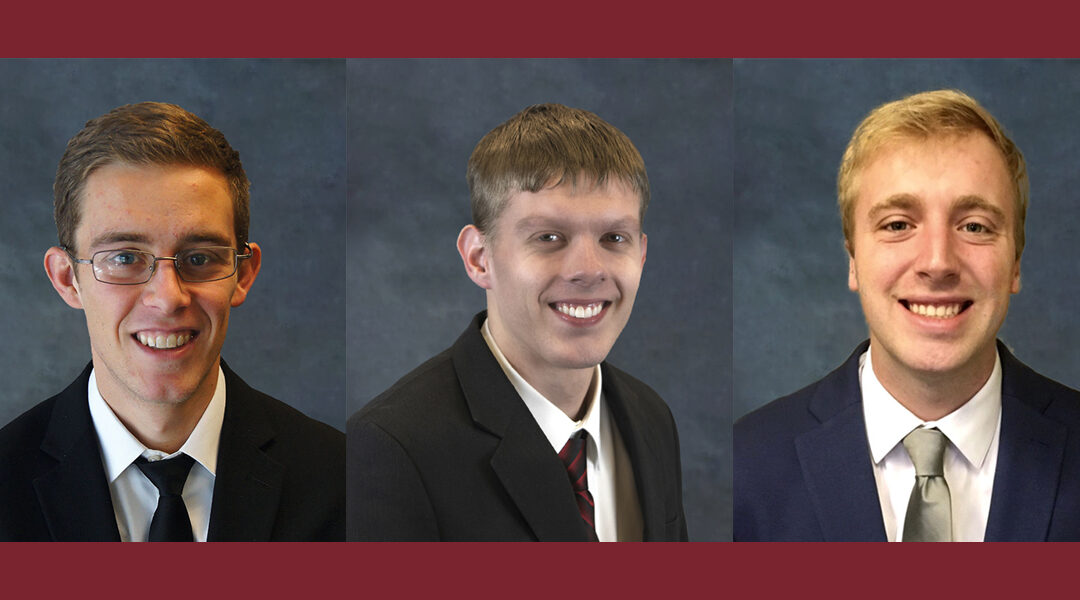

New Year. New Promotions.

Chicago, IL, January 19, 2021 Bronswick Benjamin is pleased to announce three promotions of our professionals. Dylan Creger will be promoted from Senior Accountant to Supervisor. Daniel Fredrickson and David Thompson will transition from their current roles as...

PPP Application Dates Announced

PPP Application Dates Announced The application window for Paycheck Protection Program (PPP) forgivable loans will open Friday for lenders with $1 billion or less in assets, the US Small Business Administration and Treasury announced. The opening, which will take...